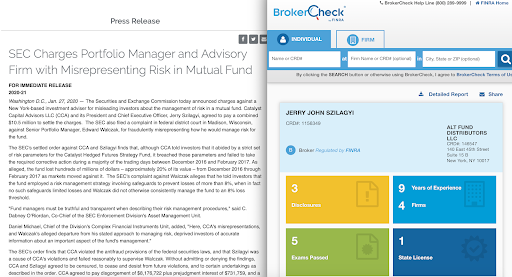

Erez Law is currently investigating Catalyst Capital Advisors, LLC president and chief executive officer (CEO) Jerry Szilagyi (CRD# 1156349) regarding Catalyst Hedged Futures Strategy Fund investment losses. Szilagyi has been registered with Alt Fund Distributors LLC in New York, New York since 2015.

In January 2020, the Securities and Exchange Commission (SEC) sanctioned Szilagyi to a $300,000 civil and administrative penalty and fine and issued cease-and-desist proceedings against Catalyst Capital Advisors, LLC and its President and CEO, Szilagyi, regarding, “material misstatements and omissions made by CCA in connection with the Catalyst Hedged Futures Strategy Fund (the “Fund”), a mutual fund that CCA advises and that invests primarily in options on S&P 500 index futures contracts.”

According to the SEC, “CCA made misrepresentations to investors in the Fund concerning its risk management procedures and the existence of stop loss measures and triggers to cap or otherwise limit losses which were inconsistent with CCA’s actual practices. CCA and the Fund’s lead portfolio manager (the “Senior Portfolio Manager”) also failed to manage the Fund’s risks consistent with the Fund’s prospectus, which stated that CCA would employ strict risk management procedures. Szilagyi -the President, Chief Executive Officer, Co-Founder, and majority owner of CCA -was a cause of CCA’s violations and also failed reasonably to supervise the Senior Portfolio Manager in connection with the Fund’s risk management. The Fund lost approximately 20% of its net asset value -more than $700 million. After the Commission’s investigation had begun, CCA voluntarily retained an outside consultant to review and evaluate its risk procedures and practices, and has made structural enchancements to its risk management and supervisory functions. As a result of his conduct, Szilagyi failed reasonably to supervise the Senior Portfolio Manager within the meaning of Section 203(e)(6) of the Advisers Act and Szilagyi was a cause of CCA’s violations of Sections 206(2) and 206(4) of the Advisers Act and Rule 206(4)-8 thereunder.”

Catalyst Capital Advisors LLC and Szilagyi agreed to pay a combined $10.5 million to settle the charges, which included disgorgement of $8,176,722 plus prejudgment interest of $731,759, and a civil penalty of $1,300,000, according to the SEC. Additionally, “The SEC also filed a complaint in federal district court in Madison, Wisconsin, against Senior Portfolio Manager, Edward Walczak, for fraudulently misrepresenting how he would manage risk for the fund.” The SEC complaint also alleges that Walczak, “he told investors that the fund employed a risk management strategy involving safeguards to prevent losses of more than 8%, when in fact no such safeguards limited losses and Walczak did not otherwise consistently manage the fund to an 8% loss threshold.”

Szilagyi has been the subject of one customer complaint from 2017, according to his CRD report:

August 2017. “Misleading Statements Regarding Catalyst Hedged Futures Strategy Fund.” The customer is seeking $600,000,000 in damages and the case is currently pending.

Pursuant to FINRA Rules, member firms are responsible for supervising a broker’s activities during the time the broker is registered with the firm. Therefore, Alt Fund Distributors LLC may be liable for investment or other losses suffered by Szilagyi’s customers.

Erez Law represents investors in the United States for claims against brokers and brokerage firms for wrongdoing. If and have experienced investment losses, please call us at 888-840-1571 or complete our contact form for a free consultation. Erez Law is a nationally recognized law firm representing individuals, trusts, corporations and institutions in claims against brokerage firms, banks and insurance companies on a contingency fee basis.

"*" indicates required fields